My Year (or Two) in Review, Critical Lessons & 2017 Goals

2016 has come to a close. I have many thoughts about it & the events leading up to me writing this post today. I'm pretty long winded as you all know by now, and greatly appreciate all who read my ramblings, thank you! Going to keep this one as condensed as possible.

I'm calling this a Year (or Two) in Review because well, thats what it is. There were two real defining moments for me on my trading journey thus far, both of them coming in 2015, actually. I couldn't realize them to be defining moments at the time or write about them then, because this stuff doesn't make light of itself until the dust settles, but they were. We'll start in May of 2015, when I was the greatest trader of all time. Obviously.

I had been in IU since 2014, blew up a couple tiny accounts, and started to see some real success in early 2015. I wasn't using huge size, just racking up nice consistent days. But I wanted more. Like seemingly every single struggling trader I talk to these days - I was trying to hit the fast forward button. I was going to be a millionaire any day now. All you have to do is follow your rules and trading is easy! Anyyyy day now...

So I had started to make a little money, I want to say I had about 40K in total trading capital. I opened up a new 5K SureTrader account that I had dedicated to trying to "press the issue" and use some size on smallcaps. I felt I was ready to do this, obviously completely wrong, but that was just the place I was in at the time, still very naive. The very first day I opened the account was when PTBI was running, so I said "fuck it" - channeled my inner Elkwood, and used every ounce of buying power they would allow me to, and bought $29,700 worth of PTBI. It ran a buck or two that day, and I doubled my account in a matter of hours, I still have the screenshot pictured below. I was still trading on the ST Web Platform! Makes me cringe now, but I was. Look at the T&S fills lol, I wasn't even scaling yet at this point, just "yep..one entry sounds good, I'll just go all-in right now and see what happens." I did this a couple times that morning. Oh Dante.

Long story short - I figured this was "it". All I had to do was grow some balls, and size up. I was golden. Oh Dante. Dante Dante Dante. Sit down for a minute kid, let's talk.

If "golden" is another word for an idiotic, delusional greedy pig....then I was golden alright. So now overnight I've doubled the account, 5K became 10K. The very next day I went right back to the same idea, and tried the exact same thing, and PTBI sold off the entire session. I added. I added some more. Sold for a loss. Rebought. Did it again. And again. And by the end of the day, I literally gave it all back. And I don't mean just the gains from the prior day, I mean the entire account. That was the 5th and final chapter to my blown account saga.

"Grow Some Balls" Account Value recap:

May 5th, 2015: $5000.00

May 6th, 2015: $9791.60

May 7th, 2015: $387.19

Not a typo. Not missing any zeros. I just blew the entire thing up, and had no excuses for doing it. Plain and simple.

I'm not sure if I"m alone here or not, but I'll throw it out there. I had this general "danger" meter in my head when managing a position. Say a loss went from like -200 to 400-500, I'd have been very concerned. But once it got past a certain point, I just didn't care anymore. Well I don't know if "didn't care" is the right description....but a switch flipped, and I got a lot looser, and was more in denial & pray mode rather than risk management mode. Does that make sense? Like a small red number going to 400-500 bothered me a lot, but say it ballooned to -1K, then I would see -1100, -1300, -1400, and it was all the same to me at that point (in my head) - it didn't concern me as much anymore because all I was thinking about was when it was going to come back down. Thats sort of the "deer in the headlights" moment. THIS is what ruins us. This is what attributed to every single one of my blowups. This is why, until you are more disciplined, you need to set max loss numbers with your broker, where if you hit a particular unrealized loss, all positions will be automatically liquidated & account frozen for the remainder of the session - those features. That is what prevents blowups. You will always think you are stronger than you are. You will always have faith in yourself that should you get put in that sticky situation, you'll do the right thing. But chances are, you won't. Not in the beginning at least. So try taking the decision out of your hands sometimes. Use, at absolute minimum, hard stops - but the max loss at broker is also another life saving tool. And don't underestimate the amount of mental capital you're protecting as well by doing that. Consider it if you're still currently struggling and dealing with blown account syndrome. Had I had either of those things in place on my ST account that day, it would have saved me so much money. But I didn't even know those options existed until much later in my trading journey.

Turning point lesson #1 - DON'T try to hit the fast forward button because of all the big money you see floating around on Twitter. Pay your dues. You hear this stuff all the time, I know. It's cliche, I know. But it's said so often for a reason. I am begging you to pay more attention to the things I say in these blogs, and the things you constantly read over and over all over Twitter and dismiss as "yeah yeah, got it" propaganda. Pull your head out of your ass, stop thinking you're "different" or better than everyone else, and pay your dues. End of discussion. There is no fast forward button. Are you hearing me? It doesn't exist.

So that was a big moment for me. I went back to my IB account that I had worked hard to build up over the prior year, with my tail between my legs. But I was proud of myself in a sense - that I knew I shouldn't try those games with my main account, and I mitigated risk by opening the ST account, where "absolute worst case scenario" here I lose 5K (or 10K but who's counting). That was a lot better than taking one of those major account crippling losses. I would see horror stories of guys posting these huge losses and just think "wtf? how does that even happen, how stupid can you be?" I was better than that. That would never happen to me. Never.

Funny story! It happened. Lets fast forward a couple months. I had mentally recovered from the PTBI debacle and had lesson #1 well in hand, wasn't looking for a fast forward button anymore, and went right back to business as usual, trading within my means and racking up unassuming green days. June, July, August, September, all nice profitable months for me in 2015. Then came October.

One word: Oprah. Middle of October WTW gapped up 100% from 6 to 12, and everyone was laughing, jokes all around about what an easy short this would be, complete joke of a company. Yep....it turned out to be a joke alright. Except the joke was on me. I was short on Day 1 with a mid 12's average, and ended up covering two days later, right near the very top (or so we thought) in the 19s, thinking "here comes 20 & all bets are off". We don't need to discuss numbers there, you can use your imagination. It wasn't pretty, but it happened. The one thing I swore never would - I took a massive account crippling loss. About a 60% haircut of my total trading capital. I was devastated.

Turning point lesson #2: The second your trade thesis is invalidated, RUN. It's fine to add to a loser in the right context, but that better have been in the cards ahead of time & part of the plan, and done in a very controlled manner. I did not do that, not even close. My plan was "Weight Watchers? Seriously? This was big in like 1999. 100% gapper? LOL. I'll just wait this out." Great plan buddy. Cliche comment #1623 of the post: If you don't have a set plan for every parabolic short play, or any play for that matter, you're done. If you've avoided trouble thus far - just wait. It's coming. You can run, but you can't hide. The market humbles all who fail to adequately prepare, and makes zero exceptions.

Use hard stops at first as training wheels, so you get used to the feeling of being stopped out of a trade, and realizing thats okay. Because it's going to happen.

That was one of the hardest days of my life, to sit there and soak in what had just happened, and to realize I had erased over 50% of my hard work in the last year. All gone, in one brief lapse in judgement. It's that quick, and that easy. No matter how prepared you think you were for it, your ego still takes over. You literally know that you're making a mistake, and you make it anyway. And it doesn't really register in your head right away, there's sort of a denial phase first. It really registered for me the next morning when I opened my account and saw the Equity number annihilated.

I believe the quote goes "Experience is something you don't get until just after you need it." And thats unfortunate, but necessary. Don't ever think you're a failure because you did one of the dumbest things imaginable in trading. Its almost a rite of passage. It's not a setback, it's a springboard to the next stepping stone if you harness it correctly.

What seemed like the worst thing that could have ever happened, turned out to be the best thing that could have ever happened, because from November 2015 on - it's been amazing, and 2016 has been a breakout year. That loss rocked me so hard that it literally drilled a lesson into my brain, whether I liked it or not, it was in there. I was SO aware of what disaster looked like and felt like now that I had danced with it. I had my head on a swivel looking for it, permanently. Not that I was "scared", I wasn't, but you better believe I was ready for it, and had much more respect for it. Mindful of it would be a better word.

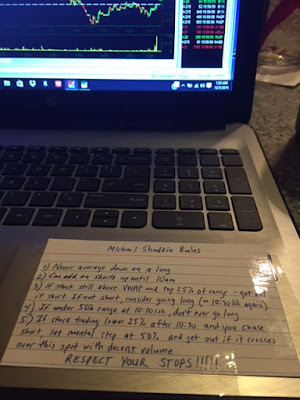

And that was huge for me. I also started a small room to try and instill these lessons in other newer traders, which I still run, and it turned into something that had way more benefit that I could have ever imagined. To constantly say my rules out loud (I livestream daily) to others. That was further solidifying everything I knew and preached, without even realizing it in the beginning. It was a way to keep me accountable day in and day out. I discuss why that's important here, and it brought me to a group of guys whom I can now call trading partners, and more importantly, friends.

I would probably never have been motivated to do any of this had I not been slapped silly by reality and had my flaws as a trader thrown right in my face. Adversity and hardship are the precursors to all significant growth. You have to find the positives in every negative situation that gets thrown at you in this game. It will be discouraging beyond belief sometimes, but you need to spin everything as positively as possible and learn from it, let it make you better, not bitter. If it doesn't kill you, it only makes you stronger.

So that was the roller coaster ride of events to date in my young trading career that culminated in 2015. Conventional? Not quite. But I wouldn't change a thing. (What is conventional anyway?) I could talk about some of the wins too, but I think the losses offer a lot more value. And I'm sure there are many more stops to come on the roller coaster, thats in our job description as risk takers on the NASDAQ playground.

2016 Recap

Admittedly, I had not grown as much as I would have liked, and by grown, I'm simply referring to my position sizes. Most were between 1-4K, occasionally getting into the 5-10K size range in the latter half of the year, and that was about it. I can count on two hands the amount of trades I was over 10K shares, and on one hand the times it was over 20K shares. I'd like to get to the point where I can really hammer the big ones, and I think you need a certain amount of mental capital to do that, which I hope to find by accomplishing my 2017 goals listed below.

Mentally & consistency wise, I think I grew a ton. I got to a point where I feel balanced, and fully expect to be green every day, not in a cocky way, just a confident one, and when I was red, it didn't bother me because it was almost always planned. Planned in the sense the red days were very controlled, and just resulted from ideas that didn't work out, stops were in place & adhered to, I didn't continue to aggressively trade on those days trying to turn them green like I would have in the past, etc. Lull & boredom trading have become very rare, I still do it once in a while, but much less often. I've become an avid reader to pass the time in those situations, which has a double benefit. Not only am I not trading crap, I'm learning a lot about life and how to improve myself outside of trading, which inadvertently helps improve your trading, you just don't realize it. In 2015 before I opened my room, I'd go to the gym during the lull to avoid it. 2016 was books. 2017-20XX will also be books. Lot of good tweaks this year.

I had an overall win rate for the year of 76.9%, so green just about every 3 out of 4 sessions give or take. Very pleased with it.

Goals for 2017

I guess the two main things are sizing up more, getting to that "next level", and becoming more research oriented. The two kind of go hand in hand to me, by becoming more research oriented & advanced there, you develop a stronger edge, which in turn gives you stronger conviction on the trade, which allows you to more comfortably size into the position. I'm a pretty calm person by nature already (was a little too calm on WTW D-Day lol), so I think this will be a somewhat smooth transition, whenever it does happen. Looking forward to it.

"Know what you are trading." If you don't know what you're trading, what are you even doing? Might as well put a blindfold on and go to church more if you don't fully understand the circumstances around what you're trading, and WHY it's moving. Everyone is focused on the fact "It's moving, it's moving! Nice!" But nobody seems to look into "WHY" further than the headline of a PR. 2017 for me is dedicated to taking the "Why" to a whole new level and understanding it inside and out.

So those are my two main goals. I've started a bit by laying out some early suspects here - and I'd like to take that level of research and improve it tenfold, really digging into the dirt on these smallcaps and truly trading with a significant edge.

We shall see! I'm very excited to see what 2017 has in store. I'll probably be tweeting a little less, not altogether, but just about the pigs - broadcasting your research to the world is not always the best course of action, in an effort to keep the masses away from crowding the best ideas. But I'll still be prevalent on the blog too. I'm running out of psychological stuff to throw at you in these posts before it will just be redundant, so maybe I'll get back to some Daily Trade Recap blogs like the old days, who knows!

Short & Honest Assessment of Progress To Date:

2014 Theme: Whoops

2015 Theme: Try Not to Die You Idiot

2016 Theme: Consistency & Process

2017 Theme: Growth

Hope you enjoyed the read, and wishing everyone a happy, healthy, and profitable New Year!

- D

I'm calling this a Year (or Two) in Review because well, thats what it is. There were two real defining moments for me on my trading journey thus far, both of them coming in 2015, actually. I couldn't realize them to be defining moments at the time or write about them then, because this stuff doesn't make light of itself until the dust settles, but they were. We'll start in May of 2015, when I was the greatest trader of all time. Obviously.

I had been in IU since 2014, blew up a couple tiny accounts, and started to see some real success in early 2015. I wasn't using huge size, just racking up nice consistent days. But I wanted more. Like seemingly every single struggling trader I talk to these days - I was trying to hit the fast forward button. I was going to be a millionaire any day now. All you have to do is follow your rules and trading is easy! Anyyyy day now...

So I had started to make a little money, I want to say I had about 40K in total trading capital. I opened up a new 5K SureTrader account that I had dedicated to trying to "press the issue" and use some size on smallcaps. I felt I was ready to do this, obviously completely wrong, but that was just the place I was in at the time, still very naive. The very first day I opened the account was when PTBI was running, so I said "fuck it" - channeled my inner Elkwood, and used every ounce of buying power they would allow me to, and bought $29,700 worth of PTBI. It ran a buck or two that day, and I doubled my account in a matter of hours, I still have the screenshot pictured below. I was still trading on the ST Web Platform! Makes me cringe now, but I was. Look at the T&S fills lol, I wasn't even scaling yet at this point, just "yep..one entry sounds good, I'll just go all-in right now and see what happens." I did this a couple times that morning. Oh Dante.

Long story short - I figured this was "it". All I had to do was grow some balls, and size up. I was golden. Oh Dante. Dante Dante Dante. Sit down for a minute kid, let's talk.

If "golden" is another word for an idiotic, delusional greedy pig....then I was golden alright. So now overnight I've doubled the account, 5K became 10K. The very next day I went right back to the same idea, and tried the exact same thing, and PTBI sold off the entire session. I added. I added some more. Sold for a loss. Rebought. Did it again. And again. And by the end of the day, I literally gave it all back. And I don't mean just the gains from the prior day, I mean the entire account. That was the 5th and final chapter to my blown account saga.

"Grow Some Balls" Account Value recap:

May 5th, 2015: $5000.00

May 6th, 2015: $9791.60

May 7th, 2015: $387.19

Not a typo. Not missing any zeros. I just blew the entire thing up, and had no excuses for doing it. Plain and simple.

I'm not sure if I"m alone here or not, but I'll throw it out there. I had this general "danger" meter in my head when managing a position. Say a loss went from like -200 to 400-500, I'd have been very concerned. But once it got past a certain point, I just didn't care anymore. Well I don't know if "didn't care" is the right description....but a switch flipped, and I got a lot looser, and was more in denial & pray mode rather than risk management mode. Does that make sense? Like a small red number going to 400-500 bothered me a lot, but say it ballooned to -1K, then I would see -1100, -1300, -1400, and it was all the same to me at that point (in my head) - it didn't concern me as much anymore because all I was thinking about was when it was going to come back down. Thats sort of the "deer in the headlights" moment. THIS is what ruins us. This is what attributed to every single one of my blowups. This is why, until you are more disciplined, you need to set max loss numbers with your broker, where if you hit a particular unrealized loss, all positions will be automatically liquidated & account frozen for the remainder of the session - those features. That is what prevents blowups. You will always think you are stronger than you are. You will always have faith in yourself that should you get put in that sticky situation, you'll do the right thing. But chances are, you won't. Not in the beginning at least. So try taking the decision out of your hands sometimes. Use, at absolute minimum, hard stops - but the max loss at broker is also another life saving tool. And don't underestimate the amount of mental capital you're protecting as well by doing that. Consider it if you're still currently struggling and dealing with blown account syndrome. Had I had either of those things in place on my ST account that day, it would have saved me so much money. But I didn't even know those options existed until much later in my trading journey.

Turning point lesson #1 - DON'T try to hit the fast forward button because of all the big money you see floating around on Twitter. Pay your dues. You hear this stuff all the time, I know. It's cliche, I know. But it's said so often for a reason. I am begging you to pay more attention to the things I say in these blogs, and the things you constantly read over and over all over Twitter and dismiss as "yeah yeah, got it" propaganda. Pull your head out of your ass, stop thinking you're "different" or better than everyone else, and pay your dues. End of discussion. There is no fast forward button. Are you hearing me? It doesn't exist.

So that was a big moment for me. I went back to my IB account that I had worked hard to build up over the prior year, with my tail between my legs. But I was proud of myself in a sense - that I knew I shouldn't try those games with my main account, and I mitigated risk by opening the ST account, where "absolute worst case scenario" here I lose 5K (or 10K but who's counting). That was a lot better than taking one of those major account crippling losses. I would see horror stories of guys posting these huge losses and just think "wtf? how does that even happen, how stupid can you be?" I was better than that. That would never happen to me. Never.

Funny story! It happened. Lets fast forward a couple months. I had mentally recovered from the PTBI debacle and had lesson #1 well in hand, wasn't looking for a fast forward button anymore, and went right back to business as usual, trading within my means and racking up unassuming green days. June, July, August, September, all nice profitable months for me in 2015. Then came October.

One word: Oprah. Middle of October WTW gapped up 100% from 6 to 12, and everyone was laughing, jokes all around about what an easy short this would be, complete joke of a company. Yep....it turned out to be a joke alright. Except the joke was on me. I was short on Day 1 with a mid 12's average, and ended up covering two days later, right near the very top (or so we thought) in the 19s, thinking "here comes 20 & all bets are off". We don't need to discuss numbers there, you can use your imagination. It wasn't pretty, but it happened. The one thing I swore never would - I took a massive account crippling loss. About a 60% haircut of my total trading capital. I was devastated.

Turning point lesson #2: The second your trade thesis is invalidated, RUN. It's fine to add to a loser in the right context, but that better have been in the cards ahead of time & part of the plan, and done in a very controlled manner. I did not do that, not even close. My plan was "Weight Watchers? Seriously? This was big in like 1999. 100% gapper? LOL. I'll just wait this out." Great plan buddy. Cliche comment #1623 of the post: If you don't have a set plan for every parabolic short play, or any play for that matter, you're done. If you've avoided trouble thus far - just wait. It's coming. You can run, but you can't hide. The market humbles all who fail to adequately prepare, and makes zero exceptions.

Use hard stops at first as training wheels, so you get used to the feeling of being stopped out of a trade, and realizing thats okay. Because it's going to happen.

That was one of the hardest days of my life, to sit there and soak in what had just happened, and to realize I had erased over 50% of my hard work in the last year. All gone, in one brief lapse in judgement. It's that quick, and that easy. No matter how prepared you think you were for it, your ego still takes over. You literally know that you're making a mistake, and you make it anyway. And it doesn't really register in your head right away, there's sort of a denial phase first. It really registered for me the next morning when I opened my account and saw the Equity number annihilated.

I believe the quote goes "Experience is something you don't get until just after you need it." And thats unfortunate, but necessary. Don't ever think you're a failure because you did one of the dumbest things imaginable in trading. Its almost a rite of passage. It's not a setback, it's a springboard to the next stepping stone if you harness it correctly.

What seemed like the worst thing that could have ever happened, turned out to be the best thing that could have ever happened, because from November 2015 on - it's been amazing, and 2016 has been a breakout year. That loss rocked me so hard that it literally drilled a lesson into my brain, whether I liked it or not, it was in there. I was SO aware of what disaster looked like and felt like now that I had danced with it. I had my head on a swivel looking for it, permanently. Not that I was "scared", I wasn't, but you better believe I was ready for it, and had much more respect for it. Mindful of it would be a better word.

And that was huge for me. I also started a small room to try and instill these lessons in other newer traders, which I still run, and it turned into something that had way more benefit that I could have ever imagined. To constantly say my rules out loud (I livestream daily) to others. That was further solidifying everything I knew and preached, without even realizing it in the beginning. It was a way to keep me accountable day in and day out. I discuss why that's important here, and it brought me to a group of guys whom I can now call trading partners, and more importantly, friends.

I would probably never have been motivated to do any of this had I not been slapped silly by reality and had my flaws as a trader thrown right in my face. Adversity and hardship are the precursors to all significant growth. You have to find the positives in every negative situation that gets thrown at you in this game. It will be discouraging beyond belief sometimes, but you need to spin everything as positively as possible and learn from it, let it make you better, not bitter. If it doesn't kill you, it only makes you stronger.

So that was the roller coaster ride of events to date in my young trading career that culminated in 2015. Conventional? Not quite. But I wouldn't change a thing. (What is conventional anyway?) I could talk about some of the wins too, but I think the losses offer a lot more value. And I'm sure there are many more stops to come on the roller coaster, thats in our job description as risk takers on the NASDAQ playground.

2016 Recap

Admittedly, I had not grown as much as I would have liked, and by grown, I'm simply referring to my position sizes. Most were between 1-4K, occasionally getting into the 5-10K size range in the latter half of the year, and that was about it. I can count on two hands the amount of trades I was over 10K shares, and on one hand the times it was over 20K shares. I'd like to get to the point where I can really hammer the big ones, and I think you need a certain amount of mental capital to do that, which I hope to find by accomplishing my 2017 goals listed below.

Mentally & consistency wise, I think I grew a ton. I got to a point where I feel balanced, and fully expect to be green every day, not in a cocky way, just a confident one, and when I was red, it didn't bother me because it was almost always planned. Planned in the sense the red days were very controlled, and just resulted from ideas that didn't work out, stops were in place & adhered to, I didn't continue to aggressively trade on those days trying to turn them green like I would have in the past, etc. Lull & boredom trading have become very rare, I still do it once in a while, but much less often. I've become an avid reader to pass the time in those situations, which has a double benefit. Not only am I not trading crap, I'm learning a lot about life and how to improve myself outside of trading, which inadvertently helps improve your trading, you just don't realize it. In 2015 before I opened my room, I'd go to the gym during the lull to avoid it. 2016 was books. 2017-20XX will also be books. Lot of good tweaks this year.

I had an overall win rate for the year of 76.9%, so green just about every 3 out of 4 sessions give or take. Very pleased with it.

Goals for 2017

I guess the two main things are sizing up more, getting to that "next level", and becoming more research oriented. The two kind of go hand in hand to me, by becoming more research oriented & advanced there, you develop a stronger edge, which in turn gives you stronger conviction on the trade, which allows you to more comfortably size into the position. I'm a pretty calm person by nature already (was a little too calm on WTW D-Day lol), so I think this will be a somewhat smooth transition, whenever it does happen. Looking forward to it.

"Know what you are trading." If you don't know what you're trading, what are you even doing? Might as well put a blindfold on and go to church more if you don't fully understand the circumstances around what you're trading, and WHY it's moving. Everyone is focused on the fact "It's moving, it's moving! Nice!" But nobody seems to look into "WHY" further than the headline of a PR. 2017 for me is dedicated to taking the "Why" to a whole new level and understanding it inside and out.

So those are my two main goals. I've started a bit by laying out some early suspects here - and I'd like to take that level of research and improve it tenfold, really digging into the dirt on these smallcaps and truly trading with a significant edge.

We shall see! I'm very excited to see what 2017 has in store. I'll probably be tweeting a little less, not altogether, but just about the pigs - broadcasting your research to the world is not always the best course of action, in an effort to keep the masses away from crowding the best ideas. But I'll still be prevalent on the blog too. I'm running out of psychological stuff to throw at you in these posts before it will just be redundant, so maybe I'll get back to some Daily Trade Recap blogs like the old days, who knows!

Short & Honest Assessment of Progress To Date:

2014 Theme: Whoops

2015 Theme: Try Not to Die You Idiot

2016 Theme: Consistency & Process

2017 Theme: Growth

Hope you enjoyed the read, and wishing everyone a happy, healthy, and profitable New Year!

- D

Love reading these blog posts. If you could go back to the daily trading recaps, It would be awesome. I feel like I learned alot of viewing them (watched all this weekend).

ReplyDelete

Delete💎💎 DO YOU WANT TO RECOVER YOUR LOST FUNDS ON BINARY OPTIONS AND BITCOIN INVESTMENTS??? OR YOU NEED A LEGIT HACKING SERVICE ?? TAKE YOUR TIME TO READ👇🏽👇🏽👇🏽

☑️ The COMPOSITE CYBER SECURITY SPECIALISTS have received numerous complaints of fraud associated with websites that offers an opportunity to buy or trade binary options and bitcoin investments through Internet-based trading platforms. Most Of The complaints falls into these Two categories:

1. 🔘 Refusal to credit customers accounts or reimburse funds to customers:

These complaints typically involve customers who have deposited money into their binary options trading account and who are then encouraged by “brokers” over the telephone to deposit additional funds into the customer account. When customers later attempt to withdraw their original deposit or the return they have been promised, the trading platforms allegedly cancel customers’ withdrawal requests, refuse to credit their accounts, or ignore their telephone calls and emails.

2. 🔘 Manipulation of software to generate losing trades:

These complaints allege that the Internet-based binary options trading platforms manipulate the trading software to distort binary options prices and payouts in order to ensure that the trade results in a Loss. For example, when a customer’s trade is “winning,” the countdown to expiration is extended arbitrarily until the trade becomes a loss.

☑️ Most people have lost their hard earned money through binary options and bitcoin investments, yet they would go to meet fake recovery Experts unknowingly to help them recover their money and they would end up losing more money in the process. This Is Basically why we (COMPOSITE CYBER SECURITY SPECIALISTS) have come to y’all victim’s rescue. The clue is most of these Binary option brokers have weak Database security, and their vulnerabilities can be exploited easily with the Help of our Special HackTools, Root HackTools And Technical Hacking Strategies because they wouldn’t wanna spend money in the sponsorship of Bug bounty Programs which would have helped protect their Database from Unauthorized access to their Database, So all our specialists do is to hack into the Broker’s Database via SQL Hook injections & DNS Spoofing, Decrypt your Transaction Details, Trace the Routes of your Deposited Funds, Then some Technical Hacking Algorithms & Execution Which we cant explain here would follow then you have your money recovered. 💰 💰 ✔️✔️

☑️All our Specialists are well experienced in their various niches with Great Skills, Technical Hacking Strategies And Positive Online Reputations And Recommendations💻🛠

They hail from a proven track record and have cracked even the toughest of barriers to intrude and capture all relevant data needed by our Clients.

We have Digital Forensic Specialists, Certified Ethical Hackers, Software Engineers, Cyber Security Experts, Private investigators and more. Our Goal is to make your digital life secure, safe and hassle free by Linking you Up With these great Professionals such as JACK CABLE, ARNE SWINNEN, SEAN MELIA, DAWID CZAGAN, COSTELLO FRANK And More. These Professionals are Well Reserved Professionals who you can hardly get their audience EXCEPT you reach them through us or any Other Cyber Security Company.

All You Need to Do is to send us a mail and we’ll Assign any of these specialists to Handle your Job immediately.

☑️ Below Is A Full List Of Our Services:

* FUNDS RECOVERY ON BINARY OPTIONS AND BITCOIN INVESTMENTS

* WEBSITE HACKING

* CREDIT CARD MISHAPS

* PHONE HACKING (giving you Unnoticeable access to everything Happening on the Target’s Phone)

* CLEARING OF CRIMINAL RECORDS

* SOCIAL MEDIA ACCOUNTS HACKING

☑️ CONTACT:

••• Email:

composite.cybersecurity@protonmail.com

2020 © composite cybersecurity specialists 🔘

keep up the good work man!

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThanks for sharing

ReplyDeleteof course sir, especially if every trader joined the broker FXB Trading, because this broker With this broker, traders are bound to find the best among the trading platform they will encounter in the entire trading market. It highlights popular platforms like MetaTrader 5. This website offers updated daily news and quality trading assistance for traders.

ReplyDelete