Michail Shadkin Theories of Opening Range and Intraday Relativity

So as you've heard me mention before, Michail Shadkin is one of my biggest influences in the trading community for how I think and trade, and he has formulated some outstanding guidelines to follow. Today I am going to analyze how he uses relative strength/weakness intraday to give you better conviction and know when to stay in a trade, and when to bail out.

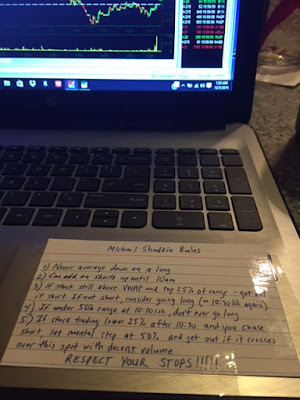

Below is a notecard I have taped to my laptop which I am forced to stare at before pushing any buttons and placing a trade. May be a little hard to read, so I'll write them out as well.

These rules are great for all traders, but especially for newer traders who should largely be avoiding the market open volatility. Wait until 10:30ish after things have consolidated, settled down and set up so you see a picture - use Michail's rules from there and you will have a much higher probability of success in your trades.

3) If stock is still above VWAP and in the top 25% of intraday range around 10:30ish - get ready to get out if short. If not short, consider going long.

PLAB ripped in the morning and could definitely be an enticing short at first glance for someone who is not seeing the bigger picture. It's after 10:30, this thing is still in the top 25% of its intraday range, there is NO reason to attempt a short here, and we know from Michail's logic, that this is actually a great spot to go long.

Below is a notecard I have taped to my laptop which I am forced to stare at before pushing any buttons and placing a trade. May be a little hard to read, so I'll write them out as well.

These rules are great for all traders, but especially for newer traders who should largely be avoiding the market open volatility. Wait until 10:30ish after things have consolidated, settled down and set up so you see a picture - use Michail's rules from there and you will have a much higher probability of success in your trades.

Michail Shadkin Rules

1) Never average down on a long

2) Can add on shorts up until ~10am (not for beginners)

3) If stock is still above VWAP and in the top 25% of intraday range around 10:30ish - get ready to get out if short. If not short, consider going long.

4) If stock is under 50% intraday range at 10:30ish, don't ever go long.

5) If stock is trading in the lower 25% of intraday range after 10:30 and you chase short, set mental stop at 50% intraday range, and get out if it crosses over this point with good volume. Consider going long.

6) RESPECT YOUR STOPS!

He has much more to say than this, but these are the basics and a few that I use regularly, and these can really improve your trading. I'll bring up a bunch of charts from Friday now where I have the intraday ranges labeled out and you can see how to use these rules to your advantage.

So the way you do this is right at 10:30 am, draw horizontal trend lines at the very top and very bottom of the intraday range so far, and then break it into quarters, 25%, 50%, 75%, and 100% of the range.

4) If stock is under 50% intraday range at 10:30ish, don't ever go long.

5) If stock is trading in the lower 25% of intraday range after 10:30 and you chase short, set mental stop at 50% intraday range, and get out if it crosses over this point with decent volume. Consider going long.

Say at 10:50 you chased this thing short at $2 waiting for the whole number break. A likely plan would be to risk on the prior peak perhaps, 2.06 in this case. Right at 11am it breaks that peak, and you may have stopped out. But using Michail's rules, you should be using the 50% intraday range level as your stop (2.11), not the prior peak of 2.06. So you can see this thing gets right up towards the 50% level, and never crosses over. Therefor you can have the confidence to let this thing go, and it would have ended up being a nice trade and fading off.

4) If stock is under 50% intraday range at 10:30ish, don't ever go long.

5) If stock is trading in the lower 25% of intraday range after 10:30 and you chase short, set mental stop at 50% intraday range, and get out if it crosses over this point with decent volume. Consider going long.

It's after 10:30, FIVE is trading in the lower 25% of its range, so you can be confident to attack here going short and it would have been a nice trade.

5) If stock is trading in the lower 25% of intraday range after 10:30 and you chase short, set mental stop at 50% intraday range, and get out if it crosses over this point with decent volume. Consider going long.

6) RESPECT YOUR STOPS!

Say you were short here in the morning - we can see right at noon LIVE crosses over the 50% intraday range with good volume, so this would be a time to either 1) cover your short or 2) consider going long. Once it crossed over the 50% intraday range there, it never went back under, so this would have been both a) smart to cover and b) smart to go long for a nice profit.

5) If stock is trading in the lower 25% of intraday range after 10:30 and you chase short, set mental stop at 50% intraday range, and get out if it crosses over this point with decent volume. Consider going long.

6) RESPECT YOUR STOPS!

We see NVAX right around 11:50 cross over the 50% intraday range with some nice volume, and this would have been an ideal spot to again both a) cover up if you were short or b) go long.

Also just a sidenote here - in yesterdays post I was discussing on my BKS trade that when you are short and a play is going your way, watch for a "speed up" in volume to the downside as a potential sign of a trend change, as this can be a good spot to cover your position. NVAX was washing out nicely through 11:30am and then you see the big "speed up" volume candle there at 11:40ish, a nice example of a pivot point and trend change - I would have been covering up there had I been short.

PLAB ripped in the morning and could definitely be an enticing short at first glance for someone who is not seeing the bigger picture. It's after 10:30, this thing is still in the top 25% of its intraday range, there is NO reason to attempt a short here, and we know from Michail's logic, that this is actually a great spot to go long.

5) If stock is trading in the lower 25% of intraday range after 10:30 and you chase short, set mental stop at 50% intraday range, and get out if it crosses over this point with decent volume. Consider going long.

TRGP was trading in the lower 25% of its range after 10:30, so we know we are confident here if we are short, using the 50% range as our stop. Stocks trading in the lower 25% are usually pretty weak, and this one was no different and would have been a great short.

Not going to post the rules again, you get the idea. Here again on VNR, if we chased this thing down or were already short, it could have been tempting to get squeezed out and cover right when it crosses over VWAP there at about 11:15. But using Michail's rules - it never breaks through the 50% intraday range of 5.11 nor does it have any good volume, so we can remain confident in our decision to be short and let this thing trade out, and it would have ended up being another great trade using patience and following rules.

After a big morning rip, ZUMZ never gets below the top 25% intraday range, so we immediately know 1) there is NO reason to try and short this, and 2) this is probably a good spot to get long. Would have worked out once again like a beauty.

This is GOOD stuff guys...utilize this in your trading and you will see much more success.

Hope this was helpful - leave a comment or shoot me a tweet @DGTrading101 if you have any questions. Thanks for reading and have a good weekend.

Dante

Super powerful stuff. Been reviewing some recent trades & gotta say this is very compelling. For example on 11/30 I shorted HD @ 134.43 with a stop @ 135.10. I failed to have previous day low on my chart that day & I covered back at B/E on the surge at 10:30!!! It not only rejected the previous day low to the penny it happened to be the EXACT place for the 50% range of the morning!!!. As you can see it failed miserably there & faded all day.

ReplyDeleteThanks for these lessons Dante, they are really valuable to newer traders, as well as seasoned ones I suppose.

Guillermo Suarez aka GLS TRADER

investing in oil and gas has and is still making a lot of people " very RICH". Investors in oil and gas are getting rich daily. All you need is a secured and certified strategy that will keep your invested capital safe by opting out with no withdrawer crunch. A considerable number of investors worldwide have seen gains of 75,063%, personally I have made over 600%. For example I started investing with $1,000 and I made $3,000, $3,500- $5,000 weekly. Last year at the start of the year, I increased my invested capital to $10,000 and I made approximately $105,000 before the end of year. I've never seen profit opportunities like this before in any market even when other traders complain of losses. Now for the doubters, not only is it possible, it's actually happening right now. All you need is a good and secured strategy, a good investment platform, Appetite and market conditions. Incase you are interested in venturing into investing or perhaps you are trading and has been losing, feel free to contact total companyat E-mail: total.company@aol.com I will

Deletebe sure to guide and assist you.

I finally found an account manager about which for the first time in 5 years I will write a positive review. sure traders Group company really showed its good side. This is both reliability in the execution of orders, and professional consultants who will always come to the rescue if force majeure suddenly happened on the market, I have no complaints about the trading platform, it works perfectly and does not freeze. With the depositing and withdrawal of funds in general there are no problems, everything comes on time. And of course, webinars which are conducted very often, for beginner traders and if you want to recorver your lost funds - I recommend expert.traders4u@gmail.com, although for those with experience too. In general, for four months I have no complaints about the company. you can whatsapp them on +263787350597 Email.... [expert.traders4u@gmail.com].

DeleteAwesome! My pleasure - Glad you were able to get something out of it.

ReplyDeletegreat post! thanks a lot. was just reading over your t4ac speech notes too. Quick question regarding the gravity theory from EPICA speech - how do you define momentum for the day? Is momentum just defined as a bigger or smaller price range. $3 move on day1 followed by $4 move on day2 = higher momo day2.

ReplyDeleteo Day 3 – take the total sum of the move from start to the close of Day 2, divide that by 4, add it to Day 2 close – this is a VERY strong entry point. One you can ADD to if they spike higher before 10 o’clock.

If Day 2 momentum is less than Day 1, divide by 3.

If momentum is more than Day 1, divide by 5 or 6, and add that to Day 2 close, and that’s the new desired entry point. Stocks don’t always make it to Day 3, but when they do they’re often golden opportunities.

Thanks man. I can't be 100% certain what Michail meant by it, but that would be a good assumption, yes. The way I look at it is on a percentage basis rather than a dollar basis - but I'd imagine you will come to the same conclusion either way, so both work.

ReplyDeleteGreat post Dante. I have read all Michails writings; having you put it into examples is very helpful. I am going through some of my trades and applying the .25 zones to see what it looks like. Would/do you use premarket data for your high & lows markers or is it strictly the 1st hour of trading 9:30-10:30 ? thanks again for the great helpful post's

ReplyDeleteI took it as just market hours, not pre. So the trading range established between 9:30 and 10:30am

ReplyDeleteHello Dante,

ReplyDeleteThanks for sharing. Do you also use his theory of measured moves in order to calculate your entry points, or do you look for other indicators in order to add, or enter the short trade. Do you add into the frontside of the move as it is still spiking, or generally wait for the backside when the stock does lower highs?

Thanks and have a great Sunday!

Manuel

This comment has been removed by the author.

ReplyDeletehey Dante,

ReplyDeleteI stumbled upon your blog page and i really like the lessons and advice you are giving it out and find it very useful. I was just wondering if there was a way to message via email or message board other then twitter thanks

Jonny,

my email is jonathanvorich_92@gmail.com

Found it! Great stuff. Looking forward to putting it to test on Monday.

ReplyDeleteHey Dante, I know how you scan for plays at 10:30 by using the top % gainers/losers and most actives, but what kind of scan do you do the night before to also find your ideas? Is there a certain set-up that you look for and like over others?

Cheers,

Johnny

I do zero scanning at night. I adapt to what the market is giving me in the morning.

DeleteThis comment has been removed by the author.

DeleteHi Dante, wich volume do u look on those top gainers/losers before 10:30?

ReplyDeleteI finally found an account manager about which for the first time in 5 years I will write a positive review. sure traders Group company really showed its good side. This is both reliability in the execution of orders, and professional consultants who will always come to the rescue if force majeure suddenly happened on the market, I have no complaints about the trading platform, it works perfectly and does not freeze. With the depositing and withdrawal of funds in general there are no problems, everything comes on time. And of course, webinars which are conducted very often, for beginner traders and if you want to recorver your lost funds - I recommend expert.traders4u@gmail.com, although for those with experience too. In general, for four months I have no complaints about the company. you can whatsapp them on +263787350597 Email.... [expert.traders4u@gmail.com].

DeleteHi Dante, wich volume do u look on those top gainers/losers before 10:30?

ReplyDeleteThanks for writing this up, Dante. I have a dullards questions for you here as I'm no mathematician: How do you work out the 25, 50 & 75% trend prices in between the high and low up to 10.30am?

ReplyDeleteHi Dante, thanks for sharing.

ReplyDeleteJust recheked these rules with few tickers, and think that there should be additional rules when you may use them.

For example see $ATV as of Jan, 11 - at 10:30 stock is right on the top of the day (in the higher 25%), so taking into account Mike's rules we can't go short. After that $ATV going down for a whole day.

The same for $FXCM as of Jan, 7, $ROVI as of Jan, 8.

Or I missed smthing?

This comment has been removed by the author.

ReplyDeleteIf it is in below 25% or top 25% range then is it not case of oversold or overbought situation? How to spot difference?

ReplyDeletevery helpful article about shorting weakness. Any experience or knowledge with using these price levels for shorting strength? IE short at 90% with risk at 100%?

ReplyDeleteGreat Blog and Great Material with Articles!!

ReplyDeleteDo these rules apply to all types of equities like say NFLX, AAPLE, FB, etc. or just the cheaper priced ones as per the screen shots shown? Thanks.

ReplyDeleteThe

ReplyDeletepivot-calculator is used to calculate pivot points in order to make the right decision while trading. A pivot point is the price at which the price fluctuation of a currency pair is expected to move into a different direction.

This comment has been removed by the author.

ReplyDeleteThis perfectly makes sense . grate post!

ReplyDelete#alexdantewebinar

This perfectly makes sense . grate post!

ReplyDelete#alexdantewebinar

Nice Blog !

ReplyDeleteबाजार में मजबूती कायम, #Nifty 11,050 के पार Free Intraday Tips

Thanks for the explanation on this concept!

ReplyDeleteLearn to Trade

ReplyDeleteHello everyone..Welcome to my free masterclass strategy where i teach experience and inexperience traders the secret behind a successful trade.And how to be profitable in trading I will also teach you how to make a profit of $12,000 USD weekly and how to get back all your lost funds feel free to email me on(brucedavid004@gmail.com) or whataspp number is +22999290178

Hello everyone..Welcome to my free masterclass strategy where i teach experience and inexperience traders the secret behind a successful trade.And how to be profitable in trading I will also teach you how to make a profit of $12,000 USD weekly and how to get back all your lost funds feel free to email me on(brucedavid004@gmail.com) or whataspp number is +22999290178

Nice blog info very helpful Mcx tips

ReplyDeleteHello everyone..Welcome to my free masterclass strategy where i teach experience and inexperience traders the secret behind a successful trade.And how to be profitable in trading I will also teach you how to make a profit of $12,000 USD weekly and how to get back all your lost funds feel free to email me on(brucedavid004@gmail.com) or whataspp number is +22999290178

ReplyDeleteYou need access to keep an eye on your spouse by gaining access to their emails?, want to know what your kids do on social networks? Whatever it is, Ranging

ReplyDeletefrom changing grades, whatsapp hack, email hack. We can get the job done. change of grades?We are team and have great feedback. We are 100% legsit His

contacts; SUPERIOR.HACK@GMAIL.COM Cell or mobile number-(+1 669 225 2253)

I finally found an account manager about which for the first time in 5 years I will write a positive review. sure traders Group company really showed its good side. This is both reliability in the execution of orders, and professional consultants who will always come to the rescue if force majeure suddenly happened on the market, I have no complaints about the trading platform, it works perfectly and does not freeze. With the depositing and withdrawal of funds in general there are no problems, everything comes on time. And of course, webinars which are conducted very often, for beginner traders and if you want to recorver your lost funds - I recommend expert.traders4u@gmail.com, although for those with experience too. In general, for four months I have no complaints about the company. you can whatsapp them on +263787350597 Email.... [expert.traders4u@gmail.com].

ReplyDelete

ReplyDeleteBEST WAY TO HAVE GOOD AMOUNT TO START A GOOD BUSINESS or TO START LIVING A GOOD LIFE….. Hack and take money directly from any ATM Machine Vault with the use of ATM Programmed Card which runs in automatic mode. email (williamshackers@hotmail.com) for how to get it and its cost . ………. EXPLANATION OF HOW THESE CARD WORKS………. You just slot in these card into any ATM Machine and it will automatically bring up a MENU of 1st VAULT $1,000, 2nd VAULT $2,000, RE-PROGRAMMED, EXIT, CANCEL. Just click on either of the VAULTS, and it will take you to another SUB-MENU of ALL, OTHERS, EXIT, CANCEL. Just click on others and type in the amount you wish to withdraw from the ATM and you have it cashed instantly… Done. ***NOTE: DON’T EVER MAKE THE MISTAKE OF CLICKING THE “ALL” OPTION. BECAUSE IT WILL TAKE OUT ALL THE AMOUNT OF THE SELECTED VAULT. email (williamshackers@hotmail.com) We are located in USA.

I never thought I will come in contact with a real and potential hacker until I knew brillianthackers800 at Gmail and he delivered a professional job,he is intelligent and understanding to control jobs that comes his way

ReplyDeleteContact him and be happy